In the complex world of taxes, there’s a term that has been gaining significant attention in recent years – the Qualified Business Income Deduction (QBID). This tax provision, introduced with the Tax Cuts and Jobs Act (TCJA) of 2017, can be a valuable tool for business owners. In this article, we will dive into the details of the Qualified Business Income Deduction, exploring what it is, who qualifies, how it works, and some tips for maximizing its benefits.

What is the Qualified Business Income Deduction?

The Qualified Business Income Deduction (QBID) is a tax benefit designed to reduce the tax burden on eligible business owners. It allows qualifying taxpayers to deduct a portion of their qualified business income from their taxable income, ultimately reducing the amount of income subject to taxation. This deduction aims to provide tax relief for small businesses, including sole proprietorships, partnerships, S corporations, and certain LLCs.

Who Qualifies for the QBID?

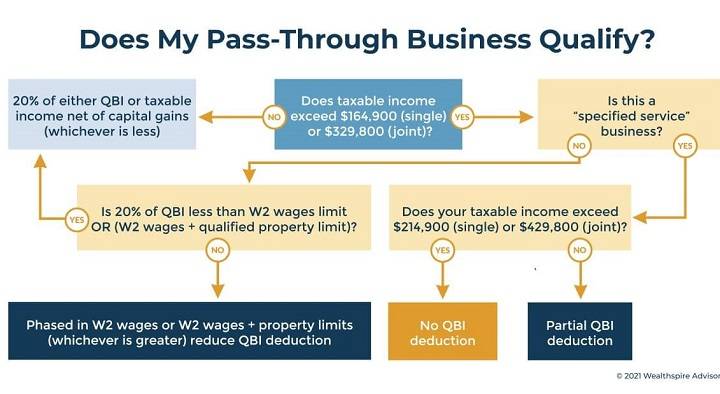

The eligibility for the QBID is based on various factors, and not all businesses or business owners will qualify. Here’s a breakdown of who may qualify for this tax deduction:

Pass-Through Businesses

The QBID primarily benefits pass-through businesses, including:

- Sole proprietorships

- Partnerships

- S corporations

- Limited Liability Companies (LLCs)

Specified Service Trades or Businesses (SSTBs)

While many businesses are eligible for the QBID, certain high-income professionals in specified service trades or businesses may face limitations or exclusions. These include doctors, lawyers, accountants, consultants, and more. It’s crucial to consult a tax professional to understand how the QBID may apply to your specific profession.

Income Limitations

The QBID is subject to income limitations. For the tax year 2022, these limitations kick in if your taxable income exceeds $329,800 (for married filing jointly) or $164,925 (for single filers). Beyond these thresholds, the deduction’s availability diminishes, particularly for SSTBs.

How Does the QBID Work?

Understanding the mechanics of the QBID is essential to make the most of this tax deduction. Here are the key points to consider:

Calculating the Deduction

The QBID allows eligible business owners to deduct up to 20% of their qualified business income from their taxable income. However, the deduction is subject to certain limitations and phase-out thresholds.

W-2 Wage and Capital Limitations

For high-income business owners and those in specified service trades or businesses, there are additional considerations. The QBID’s availability may be further limited based on the W-2 wages and the unadjusted basis of qualified property.

Reporting the Deduction

The QBID is reported on your personal tax return. For most eligible taxpayers, this means attaching Schedule C to your Form 1040. It’s crucial to keep meticulous records of your business income and expenses, as well as any necessary tax documents.

Seek Professional Guidance

Navigating the complexities of the QBID can be challenging, especially for business owners with diverse income streams or those in SSTBs. Seeking professional advice from a tax expert or CPA is advisable to ensure you maximize your eligible deductions.

Tips for Maximizing the QBID

To make the most of the Qualified Business Income Deduction, consider the following tips:

Maintain Accurate Records

Keeping detailed records of your business income, expenses, and tax-related documents is crucial. Accurate records not only help you claim the QBID but also protect you in case of an IRS audit.

Optimize Business Structure

Depending on your business, it might be beneficial to reevaluate your business structure to optimize your QBID eligibility. Consult with a tax professional to determine the best structure for your situation.

Manage Income and Expenses

Timing can impact your QBID. Consider deferring income or accelerating deductions to maximize your deduction in any given tax year.

Monitor Tax Law Changes

Tax laws are subject to change. Stay informed about updates to the QBID and other relevant tax provisions to adapt your tax planning accordingly.

In conclusion, the Qualified Business Income Deduction (QBID) is a valuable tax benefit for eligible business owners. By understanding its eligibility criteria, mechanics, and following best practices for optimization, you can potentially reduce your tax burden and keep more of your hard-earned money. However, tax laws are complex, and individual situations vary, so it’s essential to consult a tax professional for personalized guidance on leveraging the QBID to your advantage.